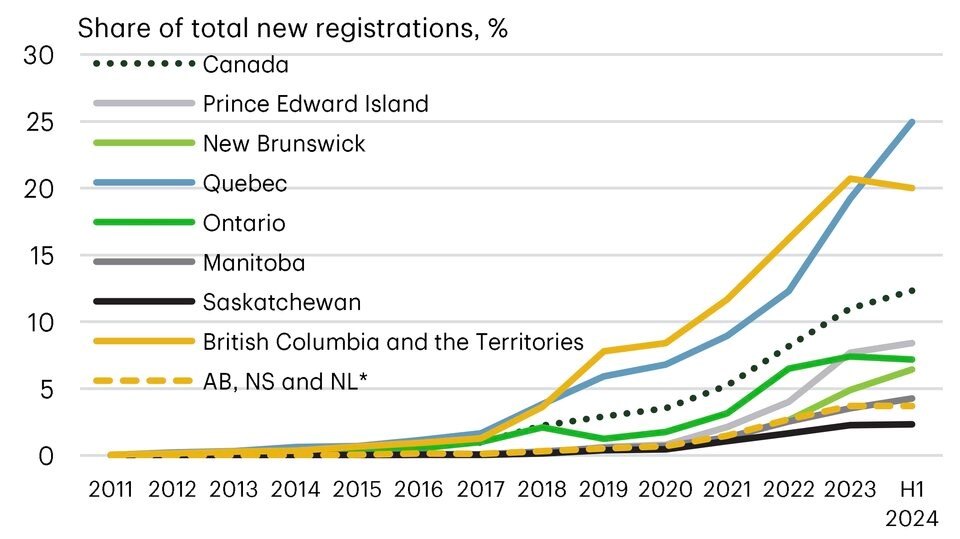

British Columbia is no longer Canada’s leader in new electric vehicle sales — a top spot ceded to Quebec after governments limited and cut access to rebate programs, data suggests.

Until 2022, any British Columbian could apply for a $4,000 rebate on an electric car as long its it was worth $55,000 or less. But that summer, the province cut eligibility to anyone making over $100,000. Only those earning less than $80,000 a year would get the full rebate.

Once a leader in electric vehicle adoption rates, B.C. has started losing ground to Quebec. By the end of 2024, the share of new vehicles that were electric dropped to 22.8 per cent, as Quebec’s surged to nearly 33 per cent, according to a report released this month from S&P Mobility.

The analysis found B.C.’s flat-lining EV sales could partly be due to market saturation or a slowing growth rate. But the numbers also suggest B.C. might need to enhance incentives to get its EV sales back on track, the report concluded.

Joanna Kyriazis, a transportation specialist with Clean Energy Canada, said most Metro Vancouver residents who can afford housing and a new car will be ineligible for the full EV rebate.

“To put an $80,000 income cap on a new electric vehicle doesn't make sense,” she said. “Anyone who is truly lower income and needs the help, they're not buying a new vehicle of any power train.”

As rebate limits have been phased in, Kyriazis thinks incentives are increasingly going to retired B.C. drivers who have lower incomes, but high equity.

B.C.'s Ministry of Energy and Climate Solutions was not immediately available to comment.

Rebate programs squeezed at all levels

In 2026, a national EV availability standard will require carmakers to increasingly offer more EVs to customers as part of federal targets that require all new light-duty vehicles to be 100 per cent zero emission by 2035.

In January, the federal government said it would end its rebate program, a move that would significantly reduce electric vehicle sales in Canada and make the federal government’s mandated electric vehicle sales targets “increasingly unrealistic,” Brian Kingston, president and CEO of the Canadian Vehicle Manufacturers' Association, said at the time.

“This comes at the same time as a slowdown in the build out of public charging infrastructure that is weighing on the pace of the transition to electric,” said Kingston in an email.

B.C. has squeezed access to its rebates in other ways. In June 2024, the provincial government cut about 75 per cent of electric and hybrid models from its rebate program.

Those restrictions mean the maximum cost of qualifying vehicles in the “cars” category — including plug-in hybrids, battery electric and fuel cell-powered cars — has dropped to $50,000 from the previous $55,000 under the CleanBC Go Electric rebate.

And earlier this month, the B.C. government tabled a budget that will eliminate a tax break on second-hand EV sales. The tax break cost the government $100 million last year.

The combined effect, said Kyriazis, has led EV sales in B.C. to essentially flatline at a moment where geopolitical tensions are propping up the cost of electric vehicles.

She pointed to a fall 2024 TD Economics report that concluded now is not the time to remove electric vehicle rebates.

Electric vehicle sales at geopolitical 'turning point'

Kyriazis said the cost of an electric vehicle today is higher than some expected. Under U.S. President Joe Biden, the Inflation Reduction Act put conditions on EV consumer tax credits requiring car manufacturers to re-draw supply chains.

Then President Donald Trump was elected, initiating a trade war and throwing the North American auto sector into chaos. His latest move Wednesday placed a 25 per cent tariff on all cars manufactured outside the U.S. — a violation of the updated USMCA free trade agreement initiated and signed by Trump in his first term.

Canada, meanwhile, has put a 100 per cent tariff on importing Chinese electric vehicle technology, a country that has made the greatest gains in lowering costs in the sector.

“We're at this turning point right now,” said Kyriazis. “Battery prices are dropping in China. But now, if we want to get Chinese-made batteries, good luck.

“There's just a lot of geopolitics that are delaying all of those promised price reductions in electric vehicles, and so it's not the right time to remove rebates.”

The lack of rebates isn’t the only thing keeping people from buying an electric vehicle. Across North America and Europe, a massive backlash against Tesla — seen by many as a reaction to owner Elon Musk’s role in the Trump administration — has led to a steep decline in sales

In several cases, people have damaged or destroyed Tesla cars, dealerships and chargers, prompting U.S. Attorney Pam Bondi to label the incidents as “domestic terrorism.”

In Europe, Tesla’s share of the electric vehicle market was cut in half over the last year, dropping to 10.3 per cent in February, from 21.6 last year.

Even as total car sales fell 3.1 per cent, overall sales of electric vehicles in Europe were up 26.1 per cent versus February 2024, data from the European Automobile Manufacturers Association (ACEA) showed this week.

And while EV sales have stagnated in British Columbia, enthusiasm to purchase electric cars appears to remain strong.

Ease of charging at home big factor in EV adoption

Across Metro Vancouver, 27 per cent of all vehicle sales were electric in 2024, the second-highest adoption in Canada after Montreal, but a 0.9 per cent decline year-over-year, according to S&P Mobility.

One major barrier to EV adoption remains access to home-charging infrastructure, according to a report published Wednesday by Kyriazis and Clean Energy Canada.

The report found that by 2024, Metro Vancouver’s highest rates of EV adoption were in the small, relatively wealthy communities where single-family homes dominate.

In Belcarra, 50 per cent of new car purchases last year were electric. In Lions Bay, EV market share has climbed to 45 per cent, and in Anmore, 43 per cent of newly registered vehicles were electric last year.

Electric vehicles made up more than 30 per cent of new car purchases in several larger cities as well, including, Tsawwassen, West Vancouver, Coquitlam, Delta, North Vancouver, White Rock, New Westminster and Port Coquitlam.

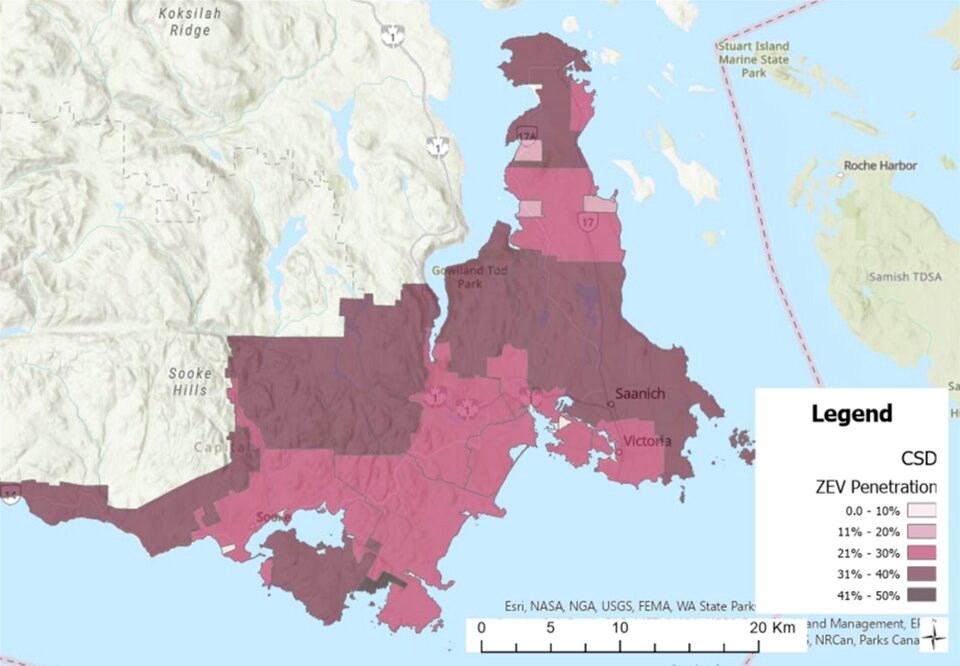

The latest S&P Mobility report also highlighted Greater Victoria’s success in 2024. The capital region saw a higher market penetration of zero-emission vehicles than any other census metropolitan area in B.C. The report found 29.5 per cent of new vehicle purchases across the region were electric last year, a 15.2 per cent spike in volume from 2023.

The increase, noted the report, “reflects the city’s commitment to sustainability and the effectiveness of local incentives promoting EVs.”

What accounted for some communities buying more electric vehicles than others?

A mix of wealth, prevalence of multi-unit residential buildings, and some policy, said Kyriazis. She also speculated those facing long commutes from places like Tsawwassen might also help explain the high rates of EV adoption.

“The more you drive, the more you save on fuel,” Kyriazis said.

Appetite to buy electric vehicle highest among young apartment dwellers

To get a better understanding of what's preventing drivers from going electric, Kyriazis and her colleagues hired Abacus Data to survey 3,000 adults across Metro Vancouver and the Greater Toronto Area.

Carried out in November 2024 and January 2025, the polling found appetite to buy an electric vehicle was strongest (78 per cent) among those 18-44 — a group that tended to live in apartment buildings where many parking stalls don’t have chargers.

While 52 per cent of Metro Vancouver residents live in apartments, they made up only 19 per cent of EV owners, the report found. The other 81 per cent of electric vehicle owners in the region reported living in a detached home where they can more easily charge their cars.

Similar trends were found in the GTA, where lower electric vehicle adoption rates tended to occur alongside weaker incentives and less stringent building code requirements to include charging infrastructure.

In Montreal — where 36 per cent of all vehicle sales were electric in 2024 — 11 out of 19 boroughs applied bylaws that require EV chargers at all parking spaces in new buildings, making it one of the “most proactive cities” in Canada, the report says.

There are currently no federal or provincial regulations in B.C. requiring new buildings to have EV charging infrastructure.

Building code amendments offer cheap EV policy at time of fiscal constraint

Unlike Quebec, B.C. has yet to draft building code amendments that would require new multi-unit apartment buildings to have electric vehicle chargers in every parking spot.

In B.C., at least 34 municipalities have bylaws that require some form of charging infrastructure. But of those, only 15 require all new parking spots to have mid-speed (Level 2) chargers, said Kyriazis.

The alternative — retrofitting old apartment buildings with EV chargers — costs three to four times more than installing them when a building is built, Clean Energy Canada found.

As the federal government plans to build four million new homes over the next decade, the problem could quickly get worse, said Kyriazis.

For governments under a lot of fiscal pressure, the report suggests changing building codes is a cheap measure to lower barriers to EV adoption. Alone, however, it won’t replace rebates, added Kyriazis.

“I feel like it's culturally insensitive — like we're being elitist saying you should give EVs to rich people,” she said.

“But it's not rich people, it's young families that have decent incomes but also high costs of living. Those are the ones who are getting blocked out of the EV rebate program. And you know, they could really use the help saving money on gas right now.”