MONTREAL — Dorel Industries Inc. is selling one of its Chinese manufacturing facilities acquired in 2014.

The Montreal-based maker of sporting goods, products for young children and home furniture says the sale is part of a strategic move to co-develop new children's products with a diverse supplier base.

The juvenile products manufacturing facility in Zhongshan will be sold to Guangdong Roadmate Group Co., Ltd. for gross proceeds of about US$51 million. However, it expects to incur a non-cash loss of about US$8 million.

Dorel will maintain its second manufacturing location in Huangshi as well as its product sourcing and quality control organizations in China that service all three of Dorel’s business segments.

The transaction does not include Dorel's domestic juvenile sales operation based in Shanghai that was acquired along with the manufacturing facility in 2014 as part of a deal valued at US$120 million.

Dorel says Roadmate will continue to be a key supplier as it co-develops new products.

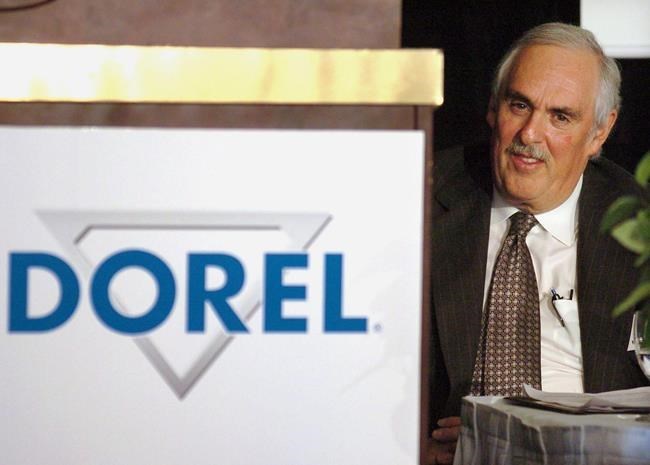

“The strategic direction is intended to allow Dorel Juvenile to further lower the required investment to bring new products to market and to deliver a broader product line with much quicker time to market," stated Dorel CEO Martin Schwartz.

He said the sale will also decrease complexity, improve cash flow and reduce volatility in the direct costs of manufacturing due to variations in currency and commodity prices.

"Dorel expects that the sale of the Zhongshan facility will also simplify the organization and free-up resources so that Dorel Juvenile can focus on product innovation and branding across its various markets."

The sale, which is subject to regulatory approval in China, is expected to close before the end of the second quarter.

Dorel will use net proceeds to reduce debt.

The transaction comes about a month after it terminated an agreement to go private after key shareholders objected to the bid led by Cerberus Capital Management that included the Schwartz family.

This report by The Canadian Press was first published March 19, 2021.

Companies in this story: (TSX:DII.B)

The Canadian Press