The COVID-19 pandemic is spurring consumers to buy more bikes and Montreal-based Dorel Industries Inc. says it has struggled to keep up with demand.

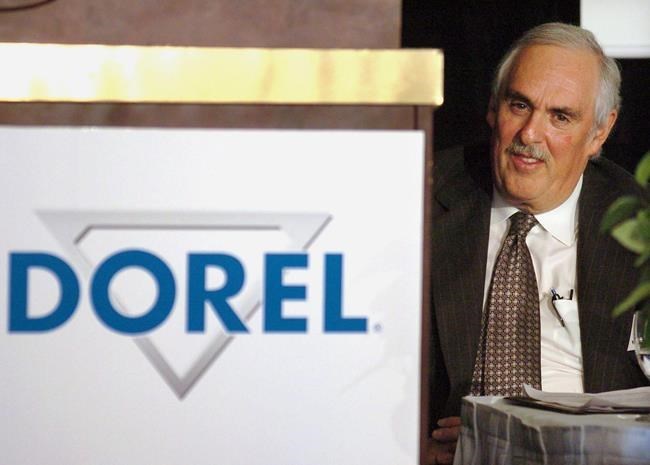

"COVID-19 has been the catalyst which has prompted many new consumers to gravitate to bikes and, going forward, we see this demand continuing to grow," chief executive Martin Schwartz said on a conference call with analysts on Friday.

Schwartz said that e-bikes are becoming the brand's No. 1 selling product, mainly in Europe.

"This is excellent news — yet current issues are affecting the entire bike industry. A shortage of bicycle components is resulting in very long lead times," he said.

Dorel, which owns bike brands such as Schwinn, Mongoose and Cannondale, said there has also been a shortage of shipping containers to get goods across the Pacific Ocean.

The company, which also makes home goods and products for young children, says its net loss grew in the fourth quarter of last year amid tax issues and the supply chain woes.

Executives told analysts that despite the surge in popularity of bikes, and hope for a line of home goods tied to the "Queer Eye" TV series, some COVID-19 trends did not help the company. For instance, lower birthrates and stay-at-home orders during the pandemic impacted the demand for car seats and strollers.

"COVID-19 is still impacting consumer behaviour, while our sports and home segments are benefiting from the higher demand," said Schwartz.

He said the costs of Dorel's products have been bumped higher by container availability, climbing commodity costs and foreign exchange rates with China.

The company, which keeps its books in U.S. dollars, reported a net loss of US$22.9 million or 70 cents per diluted share for the quarter ended Dec. 31, compared with a loss of $639,000 or two cents per diluted share a year earlier.

Revenue for the quarter totalled $704.4 million, up from $653.4 million.

On an adjusted basis, the company lost 55 cents per diluted share in its most recent quarter, compared with an adjusted profit of seven cents per diluted share a year earlier.

Analysts on average had expected an adjusted profit of 30 cents per share, according to financial data firm Refinitiv.

The maker of Safety 1st car seats terminated an agreement to go private last month after discussions with shareholders.

Executives said they are still working on a new strategic plan for the company, warning that such plans could become a "joke" given the fast-changing industry.

On the conference call, executives said shareholders see long-term value in the company, but have been concerned that the financial results are "bumpy" and inconsistent, and will need to buckle up as restructuring continues.

"There was definitely a drop in sales from reduced container availability, and as well as a less favourable customer and geographical mix. We sold a lot more lower margin products than we did in the previous quarters," said chief financial officer Jeffrey Schwartz on the call.

"We also have significant cost increases ... so we put all that together, it was a difficult quarter, but I think one that's behind us."

This report by The Canadian Press was first published March 12, 2021.

Companies in this story: (TSX: DII.B)

Anita Balakrishnan, The Canadian Press