Both opposition parties in the B.C. Legislature have formally called on the NDP government to order the B.C. Investment Management Corp. (BCIMC, or BCI) to immediately divest investment in Russian entities.

Earlier today, BC Liberals leader Kevin Falcon said premier John Horgan need to “re-evaluate investments in Russia in light of Putin’s illegal invasion of Ukraine.”

According to the BC Liberals’ statement, the BCIMC currently has investments of $103.25 million in shares of Russian state-owned bank Sberbank – as well as $83.85 million, $32.2 million and $19.16 million in Russian energy giants Lukoil, Rosneft Oil and Gazprom respectively.

The stance is rare for the BC Liberals, which traditionally supports free enterprise and separation of government and market-investment activities. But Falcon said in a statement that the Russian attack on Ukraine created a unique situation requiring immediate attention.

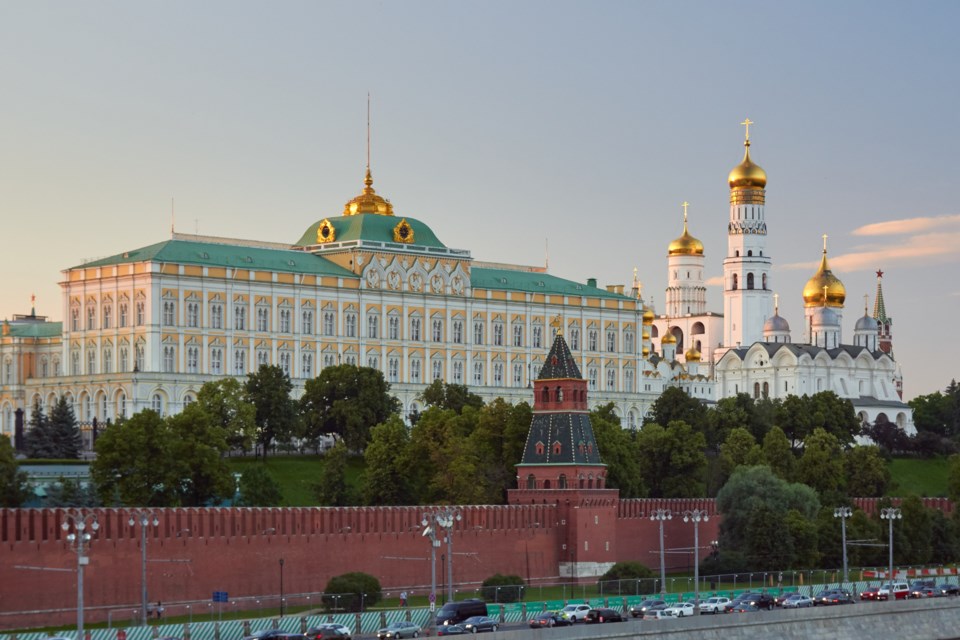

“While it is generally not appropriate for government to interfere in the decision-making of an independent body like BCIMC, I am urging the Minister of Finance, as the sole shareholder of BCIMC, to encourage immediate divestment from Russian-backed companies that are directly profiting from the conflict,” Falcon said. “... Pensioners and workers deserve answers and clarity on just how much of BCIMC’s $66.6 billion public equities portfolio is invested in state-owned companies and companies tied to the Kremlin.”

The Liberals are also pushing Horgan’s NDP government to search for evidence in B.C. land titles that may indicate ownership by the top 50 oligarchs in Russia who are allegedly supportive of Russian president Vladimir Putin and decision to invade Ukraine.

In a written response, BCI said it is aware of the situation surrounding Russia’s attack on Ukraine and is following existing Canadian sanctions on further trading of Russian securities and assets. However, BCI did not indicate it has or is planning to divest existing investments.

“As a global investor with a diversified portfolio, BCI has minimal exposure to Russia, currently representing approximately 0.2 per cent of total assets under management,” the statement said. “BCI is complying with the applicable Canadian sanctions and has restricted the trading of Russian securities within our global emerging markets program.”

The B.C. Ministry of Finance said in a statement that the provincial government "has no legal authority to instruct BCI on where or how to invest" because BCI "operates independently of the government... to avoid potential conflicts of interest."

The statement added that BCI is - like all organizations in Canada - subject to federal sanctions.

"BCI is accountable to its clients for investment returns and the investment of each clients’ funds," the ministry said. "Individually, pension plans and other and other clients of BCI can direct BCI on how to manage their own investments, as they are owners of the funds."

Officials added that Finance Minister Selina Robinson has already directed staff last week to look into land ownership records in B.C. to determine possible links to Russian oligarchs. In the meantime, the province has already removed Russian liquor from B.C. shelves and dedicated $1 million towards Ukraine through the Canadian Red Cross.

Meanwhile, BC Green Party leader Sonia Furstenau added her voice to the call for BCIMC to change, calling for the entity to “immediately divest public pension plans from all Russian-backed industries, with a plan for divestment from all oil and gas development by the end of 2022.”

The Greens are also asking for a clear outline from the province about how the action to divest will take place. As many as 690,000 B.C. residents’ pensions are administered through the BCIMC.

“According to news sources, BCI has stated it has ‘minimal exposure to Russia, currently representing approximately 0.2 per cent of total assets under management,’” Furstenau said. “But with so little invested, divesting should be a straightforward way to ensure we stand in solidarity with the Ukrainian people.”